Excel Blog

Mastering Excel’s Financial Functions

Excel’s financial functions are indispensable tools for anyone involved in financial analysis and calculations. These functions provide a wide range of capabilities to analyze data, calculate financial metrics, and make informed decisions. In this comprehensive guide, we will take you through a step-by-step process of mastering Excel’s financial functions.

We will cover essential functions such as calculating compound interest, finding present and future values, evaluating investment returns, and analyzing cash flow. Our guide will equip you with the knowledge and skills to effectively use these functions in your financial analysis and decision-making processes. Whether you are a finance professional, a business owner, or a student, this guide will enhance your proficiency in handling financial data and performing advanced calculations.

By following our detailed instructions and examples, you will gain confidence in applying Excel’s financial functions. Learn how to leverage these tools to assess investment opportunities, conduct financial forecasting, and understand the financial health of a business. Unlock the full potential of Excel’s financial functions and take your financial analysis skills to the next level.

Step 1: Opening Excel and Creating a New Workbook

- Launch Microsoft Excel on your computer.

- Click on “Blank Workbook” to create a new Excel file.

Step 2: Understanding Basic Financial Functions

- Familiarize yourself with common financial functions such as:

- SUM: Calculates the sum of a range of cells.

- AVERAGE: Computes the average value of a range.

- MAX: Finds the highest value in a set of numbers.

- MIN: Determines the lowest value in a set of numbers.

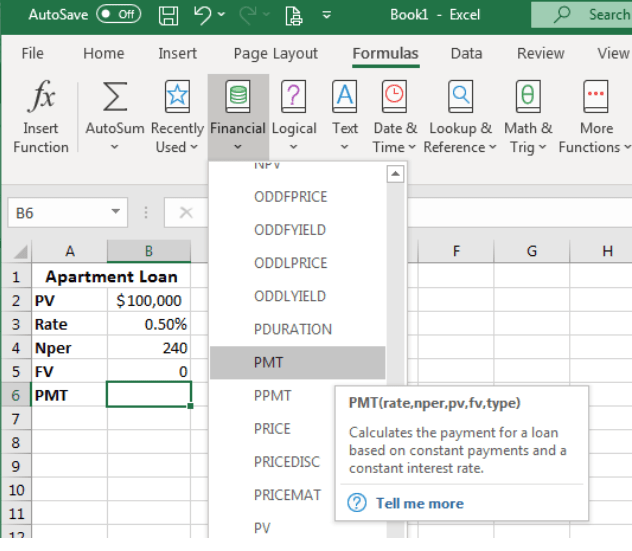

Step 3: Utilizing Financial Functions for Loan Calculations

- Decide on the loan details, including principal, interest rate, and loan term.

- Use the PMT function to calculate the fixed monthly payment for a loan.

- Syntax:

=PMT(rate, nper, pv)

- Syntax:

Step 4: Analyzing Investments with Financial Functions

- Gather data for investments, including initial investment, cash flows, and expected rate of return.

- Use the NPV function to calculate the net present value of an investment.

- Syntax:

=NPV(rate, value1, [value2],...)

- Syntax:

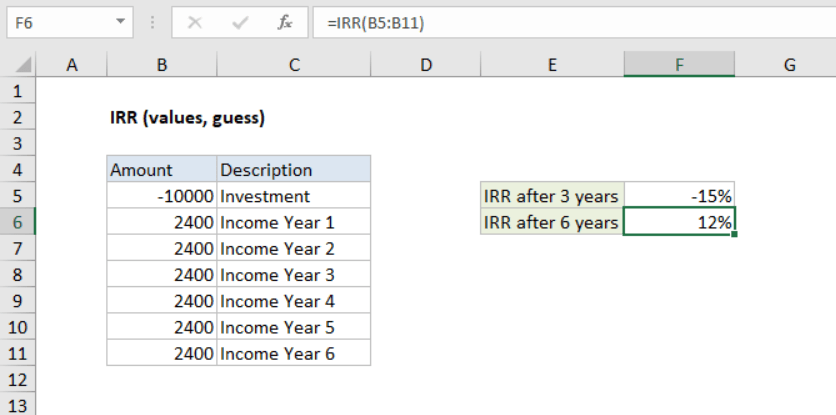

Step 5: Evaluating Financial Data with Functions

- Organize financial data in Excel, such as revenue, expenses, and cash flows.

- Use the IRR function to calculate the internal rate of return for a series of cash flows.

- Syntax:

=IRR(values, [guess])

- Syntax:

Step 6: Analyzing Loan Payments with Financial Functions

- Input loan details, including principal, interest rate, and loan term.

- Use the PMT function to calculate the monthly loan payment.

- Syntax:

=PMT(rate, nper, pv)

- Syntax:

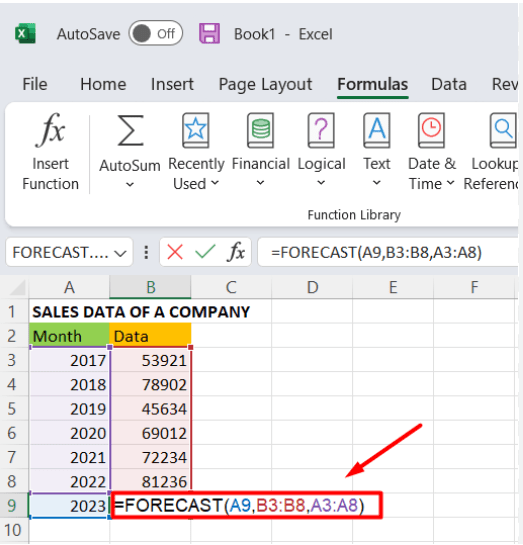

Step 7: Forecasting Financial Data

- Prepare historical financial data and input future periods.

- Use the FORECAST function to predict future values based on historical trends.

- Syntax:

=FORECAST(x,known_y's, known_x's)

- Syntax:

Step 8: Financial Function Troubleshooting

- Use the F9 key to evaluate part of a formula for troubleshooting purposes.

- Select the part of the formula you want to evaluate and press F9.

Conclusion:

Mastering Excel’s financial functions grants you the ability to efficiently analyze financial data, perform complex calculations, and make informed financial decisions. By following these step-by-step instructions and utilizing the specific commands provided, you will enhance your financial management skills and maximize your proficiency in Excel’s financial functions.

Maximize your database management efficiency with the right Microsoft Office license from our website. Browse through our options, which include Office 2016 Pro Plus keys, Office 2019 Pro Plus keys, and Office Pro Plus 2021 keys, and enhance your productivity.